"We should all be concerned about the future because we will have to spend the rest of our lives there."

If we should be concerned about the future, then the critical question for a corporate board of directors, CEO, COO, and CFO is: How will the company create value in the short-, medium-, and long-term?

A reporting framework: how a company creates value over time

Purpose

What is the purpose of the company, that is, why does the company exist?

How does the company's purpose drive the desire to obtain or ideally surpass long-term strategic goals?

Governance

How does the background, experience, and thinking represented on the board of directors contribute to guiding long-term strategic goals and succeeding in a global market?

What is the role of board in setting corporate strategy? In setting incentive compensation? In management oversight?

How is executive compensation linked to long-term strategic goals and performance metrics?

What is the company’s process for engaging with asset managers/shareowners?

Trends

What are management’s views of the markets in which it operates?

What market place trends are likely to affect the company?

What megatrends are likely to affect the company? (For example, demographic changes, technological advances).

How have/will these trends influence the business model? Medium- and long-term strategy?

Competitive Advantage

What are the sources of competitive advantage that enable the company to execute its strategy and win in the marketplace?

How does the company monitor whether it has the people, skills, and culture to sustain and improve performance.

Business Model

- How does the organization’s business model create long-term value?

Strategy

- What is the organization’s strategy to create sustained value for shareowners/asset managers?

Long-Term Value Creation and Competitive Positioning

Time frames are illustrative; they are not intended to be rigidly applied.

What performance metrics are used to monitor the company’s short-term (≤ 2 years) performance relative to long-term strategic goals? Short-term metrics generally address three broad categories: (1) Sales productivity (e.g., sales growth, market share, premium pricing ability). (2) Operating cost productivity (e.g., component costs for building a product or delivering a service). (3) Capital productivity (e.g., working capital management, free cash flow).

What performance metrics are used to monitor the company’s medium-term (2-3 years) performance relative to long-term strategic goals? Medium-term metrics generally address three broad categories: (1) Commercial health (e.g., product pipeline, strength of the brand, customer satisfaction). (2) Cost structure health (e.g., cost advantage relative to competitors). (3) Asset health (e.g., maintenance and development of assets).

What performance metrics are used to monitor the company’s long-term (> 3 years) strategic health? (Strategic health may be defined as the company’s ability to sustain its current operations and to identify and exploit opportunities for growth.)

To what extent does the company use strategic partnerships, e.g., academic or commercial relationships, to improve systems, processes, or to drive innovation? What goals and metrics have been established to monitor the progress of these initiatives?

People

- How are a person’s competencies, capabilities and experience, and motivations to innovate managed and leveraged for the benefit of the company over the long-term?

Capital Allocation

Time frames are illustrative; they are not intended to be rigidly applied.

What are the company’s capital allocation plans and how do those plans support the long-term strategic goals?

Over the next 2-3 years, what percentage of annual free cash does the company plan to allocate to growth via acquisitions? How much will be funded by divestitures?

Over the next 2-3 years, what percentage of annual free cash does the company plan to allocate to R&D and innovation?

Over the next 2-3 years, what percentage of annual free cash does the company plan to allocate to dividends and share repurchase? Capital expenditures?

Risks and Oportunities

How does the company assess financially material risks and opportunities?

What internal and external critical risks and opportunities have been identified?

How are financially material risks managed or mitigated?

How are financially material opportunities developed?

Financial Performance

To what extent has the company achieved its capital efficiency performance objectives for the period relative to long-term strategic goals? Relative to its profitability performance objectives?

To what extent has the company achieved its revenue growth performance objectives for the period relative to long-term strategic goals?

How leveraged will the company be in the future (e.g., the ratio of debt to equity)?

Is this framework a corporate reporting nirvana? Absolutely not. However, I will go to my grave secure in the knowledge that this framework is a damn good foundation for any company's annual report, integrated report, or long-term plan.

The content of this framework was inspired by:

PricewaterhouseCoopers (UK). "What does your reporting say about you?" March 2010.

International Integrated Reporting Council. "International Integrated Reporting Framework," December 2013.

Tim Koller, Marc Goedhart, and David Wessels. Valuation: Measuring and Managing the Value of Companies, 6th ed. (Hoboken, John Wiley & Sons, Inc., 2015), 547-558.

George Serafeim and Christina Rehnburg. “The Economic Significance of Long-Term Plans.” Findings presented at the CEO-Investor Forum, New York, NY, September 20, 2018.

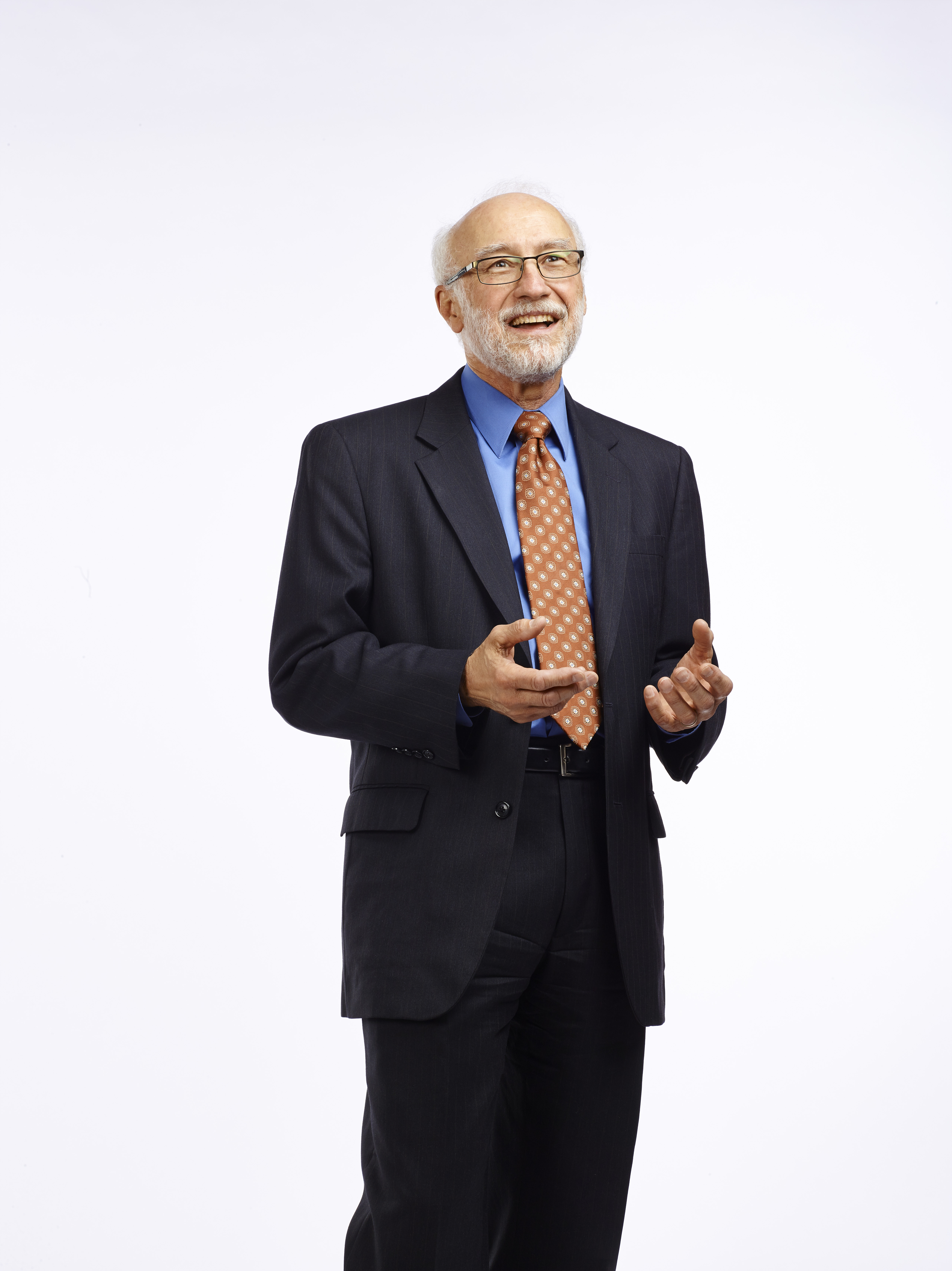

A brief professional history

- Served three years in the U.S. Army, including a tour of duty in Vietnam with the 3rd Brigade, 1st Cavalry Division (Separate).

- B.S. in Accounting and Certified Public Accountant.

- Worked 18 years in industry where I focused on SEC reporting, regulatory reporting, and internal audit.

- Worked 20 years public accounting where I focused on auditing standards, accounting principles, SEC practice, and public policy.

- Member of the SAM Research AG (today RobecoSAM) Faculty core team. Selected as a Cecil and Ida Green Honors Professor at Texas Christian University, Neeley School of Business. Named one of the Top 100 Thought Leaders in Trustworthy Business Behavior by Trust Across America.

- Coauthor of three books, The Integrated Reporting Movement; One Report; and Handbook of Accounting and Auditing (five editions).

- Author/coauthor of five book chapters, 40 articles, research papers, and HBS business cases and notes. Published in practitioner journals, including MIT Sloan Management Review, Schmalenbach Business Review, and Journal of Applied Corporate Finance.

- Speaker at 48 corporate reporting events in Belgium, Brazil, Canada, France, Germany, Italy, Japan, Netherlands, South Africa, Switzerland, United Kingdom, and the United States.

- Retired partner of Grant Thornton

- Self-employed corporate reporting consultant

Who I am; a deeper dive

Who I am is about much more than education, professional history, publications, and speaking engagements. Who I am is about my roots; it's about the bravery and tenacity of my immigrant grandparents. Who I am is about my parents; it's about the way I was raised and the values my parents passed down to me. Who I am is about the South Chicago neighborhood where I grew up; it's about 84th and Muskegon, Coles School, Bessemer Park, Mary's on Escanaba, U.S. Steel South Works, Gitter & Siovic, Bowen High School, Gassman's, the Commercial, Goldblatt's, Gayety's, and a 1960 Plymouth Valiant. Some people have told me that I lived a life of privilege. I must agree!

I am privileged to be the grandson of four Polish peasants who had the courage to journey into the unknown, enter the United States LEGALLY, pursue their American dream, and overcome the difficulties they encountered.

I am privileged to have had parents who bequeathed to me a love of family and country, a sense of honor, and the strength of character to take responsibility for my life.

I am privileged to be a U.S. Army veteran who served eleven months in Vietnam with the 3rd Brigade, 1st Cavalry Division (Separate).

I am privileged to have attended night classes to earn a Bachelor of Science in Accounting and to study for and pass the Certified Public Accountant exam at the same time I was working a full-time job.

58,000

This is my personal Vietnam War Memorial. It is my way of honoring and ensuring that I never forget Loren Pampel (Edward Coles School), Alfred Urdiales (James H. Bowen High School), and 58,000 other men and women who died in the Vietnam War.